If you’re one of the millions of Americans that rents a home, condo or apartment, chances are you’ve either had renters insurance in the past, or currently do have a policy. If you don’t have a policy, you’ll want to really pay close attention to this post.

In its most basic form, renters insurance helps cover your personal belongings from fire, theft, vandalism and other losses as well as provides you with some basic liability coverage in the event you’re found liable for bodily injury or property damages. There are also different types of renters insurance policy. A replacement cost policy will help pay for replacement of your items as if they were new. A nice thing considering that depreciated jeans, furniture and computers won’t help you become whole again.

A recent article from the Insurance Information Institute states that less than one-third of all renters (31%) have a renter’s insurance policy. Why is that? Do people assume that since they pay rent, their items are covered by that rent cost? Do they assume their landlord has insurance and it would cover this loss? Do they think maybe their auto insurance covers some items? The answer to this is that none of these items will likely cover any of your items. Only a renter’s insurance policy will.

There are 2 basic types of renters insurance:

- Actual cash value: Pays to replace your damaged or stolen items up to your policy limits, less depreciation.

- Replacement cost: Pays to replace your damaged or stolen items up to your policy limits with new ones, no depreciation.

Some additional things to consider is if you have expensive jewelry, musical equipment or collectibles that you want to insure. This may require a “floater” to be added to your policy.

One last item to ponder is how much liability you want to be covered for. You can get up to $500,000 in liability coverage. This will protect you from lawsuit. If you want even more coverage, you should consider a personal umbrella insurance policy. This goes above and beyond your renter’s limits to provide even more coverage.

Renters insurance is very inexpensive. It can come in around just 50 cents per day.

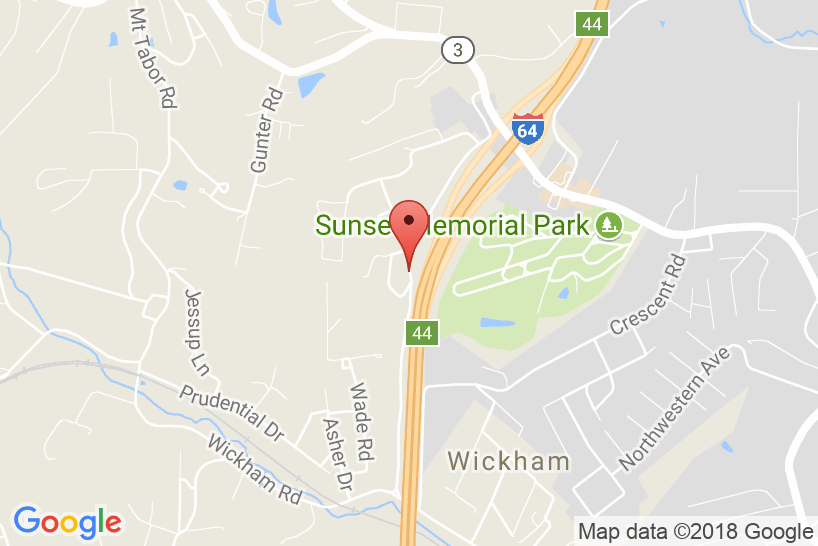

If you’d like to learn more about renters insurance in West Virginia, call Wickline Insurance. Wickline Insurance was founded in 1991 and is a leader in West Virginia with providing quality protection to hundreds of families across the state. Our Beckley, WV office can issue policies over the phone, so even if you’re not in the area, our knowledgeable, licensed insurance agents can help. We offer insurance products including auto, home, health, business and life in West Virginia. We make sure that you're covered today as well as in the future so that you can focus on what is important to you and your family. At Wickline Insurance, our #1 job is to assist you in identifying your needs and problems, while putting together a customized plan that's simple and easy to understand.