If you own property in West Virginia that you rent out — no matter what size or type it is — you need insurance to make sure you’re not vulnerable to financial risks. Here’s what you need to know about insuring rental properties, so you aren’t in danger of losing your investment and your rental income if the worst happens.

Landlord Liability Hazards

Many owners of rental properties don’t realize that they have a large liability risk by leasing their apartments or vacation homes out to others. If someone slips and falls because of a loose step, they could sue you for their injuries. You could also wind up in court due to wrongful or improper eviction, wrongful entry, slander, or libel.

Liability claims are a huge risk for landlords because they can run into millions of dollars. If you have to pay that out of your own pocket, you could deplete your assets or have future income garnished. It’s essential to have liability insurance for the kinds of incidents mentioned above, which would pay court judgments, settlements, legal fees, and other related costs.

Property Protection

Your property is also at risk of damage or loss due to things like fire, severe weather, or tenant negligence. Therefore, you need property protection for the structure and any of the contents inside that belong to you, like appliances or furnishings. Rental property insurance covers you in the event of damage, vandalism, and theft, so you don’t have to cover these expenses from your own bank account.

Who Needs Rental Property Insurance?

You might think that you don’t need rental property insurance because you just rent one unit or you live on the premises. Maybe you only rent your property during the summer vacation months. But it’s essential you have coverage year-round, no matter how large or small your rental operation is. You should have rental property insurance for:

- Part of your residence you rent out

- Leased vacation properties

- Rental investment properties (apartments, duplexes, single-family homes, etc.)

- Homestay properties (Airbnb, Vrbo, FlipKey, Homestay, etc.)

- Nonresidential rentals (garages, storage sheds, stables, etc.)

- Commercial rental properties (storefronts, offices, etc.)

Other Types of Insurance for Landlords

Depending on the size and location of your rental property business, you may wish to have other insurance to protect you from further risks, such as:

- Cyber insurance in case of ID theft, data breaches, or hacking

- Workers compensation in the event an employee is injured on the job

- Commercial auto coverage for vehicles used for business purposes

- Flood or earthquake insurance

- Umbrella insurance to increase your liability protection amount

Independent Agents Have a Larger Selection of Insurance Options

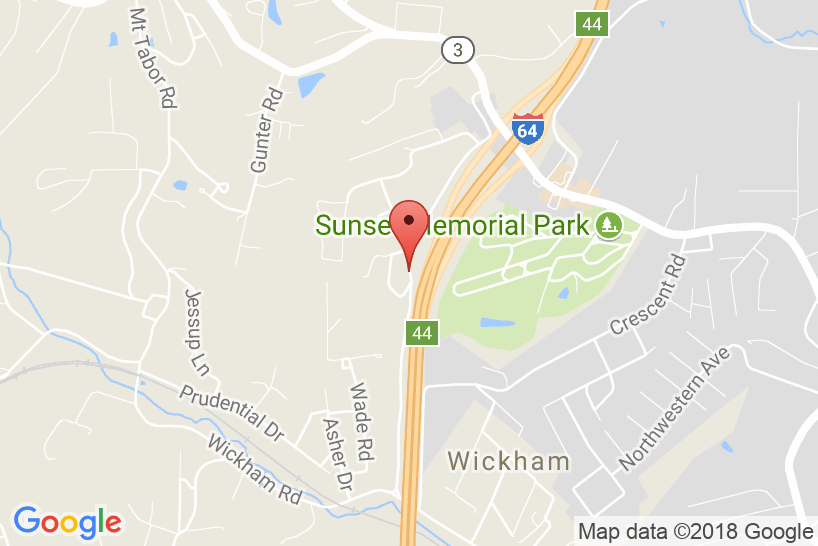

Insuring rental properties requires attention to detail and personalization because each landlord’s needs are unique. That’s why it’s better to partner with independent agents, like Wickline Insurance. We have a broader menu of insurance products, while still working with all the big carriers, and we can tailor a policy just to your needs.

Call us at 304-252-1483 today to get the protection you should have for your rental property. Or start a policy online any time at your convenience.